Decentralized Finance, or DeFi, is a revolutionary ecosystem that puts you in control of your financial world. It opens up a vast array of opportunities without the constraints and limitations of traditional financial institutions.

DeFi is transforming the way you can interact with money and access financial services.

At its core, DeFi represents a paradigm shift in how we think about and engage with finance.

It’s a movement that challenges the status quo, questioning the need for centralized control and intermediaries in our financial lives.

DeFi empowers individuals to take control of their financial destiny, offering a level of autonomy and accessibility that traditional finance has long lacked.

What is Decentralized Finance? #

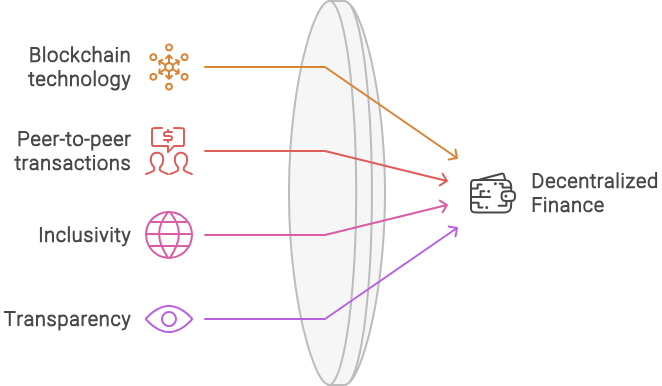

Decentralized Finance, or DeFi for short, refers to a growing ecosystem of financial applications and services built on blockchain technology, primarily on the Ethereum network. Unlike traditional finance, which relies on centralized institutions like banks and financial intermediaries, DeFi leverages the power of smart contracts and decentralized protocols to enable peer-to-peer financial transactions and services.

The key idea behind DeFi is to create an open, transparent, and accessible financial system that is not controlled by any single entity.

With DeFi, you can engage in a wide range of financial activities, such as lending, borrowing, trading, and investing, without the need for intermediaries.

This eliminates the need for trust in centralized authorities and puts you in full control of your assets.

One of the most appealing aspects of DeFi is its inclusivity.

It’s a financial system that transcends borders and welcomes anyone with an internet connection, regardless of their background or location.

By removing the barriers to entry that often plague traditional finance, DeFi opens up a world of financial opportunities to those who may have been previously excluded or underserved.

A key feature of DeFi is its transparency. Because every transaction is recorded on the blockchain, which is essentially a public ledger, there’s a level of transparency and accountability that’s unmatched in traditional finance.

This transparency helps to foster trust and reduces the potential for fraud or manipulation.

The rise of Bitcoin and blockchain technology #

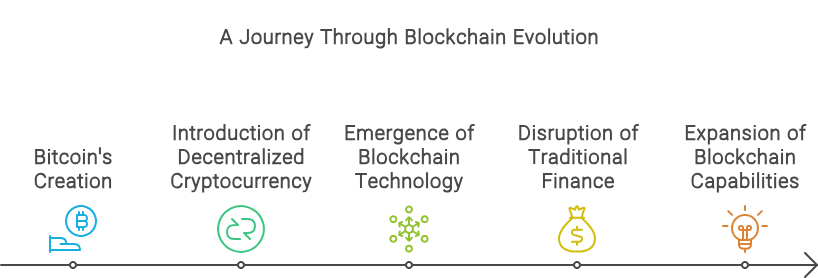

To understand the origins of DeFi, we need to go back to the creation of Bitcoin in 2009.

Bitcoin, the world’s first decentralized cryptocurrency, introduced the concept of a peer-to-peer electronic cash system that operates without the need for central authorities.

By leveraging blockchain technology, Bitcoin enabled secure, fast, and low-cost transactions, cutting out the middleman.

Blockchain, the underlying technology behind Bitcoin, is essentially a distributed ledger that records all transactions in a secure and transparent manner.

It’s a revolutionary technology that has the potential to disrupt not just finance, but a wide range of industries. By reducing reliance on intermediaries, blockchain technology can lower transaction costs, increase efficiency, and provide greater financial inclusion for individuals who are underserved by traditional financial systems.

While Bitcoin laid the groundwork for decentralized finance, its primary use case was limited to being a digital currency for peer-to-peer transactions. However, as the potential of blockchain technology became more apparent, developers began exploring ways to expand its capabilities beyond basic transactions.

Expanding beyond basic transactions #

The limitations of Bitcoin’s scripting language made it difficult to create complex financial applications on its blockchain. This led to the development of new blockchain platforms, such as Ethereum, which introduced the concept of smart contracts.

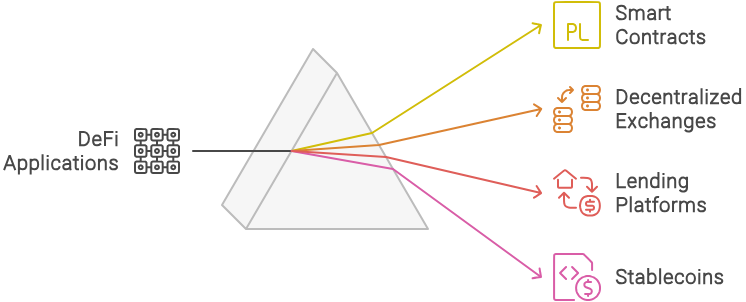

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, allowing for the automation of complex financial transactions and the creation of decentralized applications (dApps).

The introduction of smart contracts opened up a world of possibilities for DeFi applications.

Developers could now create decentralized exchanges, lending and borrowing platforms, stablecoins, and other financial instruments that operate on blockchain technology.

These applications could interact with each other, creating a vibrant ecosystem of interconnected financial services.

Decentralized exchanges like Uniswap and SushiSwap allow users to trade cryptocurrencies directly, without the need for a central authority to facilitate the transactions.

Lending platforms like Aave and Compound enable users to lend and borrow funds in a trustless manner, with interest rates determined by supply and demand rather than a bank’s discretion.

Stablecoins, such as DAI and USDC, provide a more stable store of value within the volatile cryptocurrency market.

The growth of the DeFi ecosystem has been driven by the need for more efficient, transparent, and accessible financial services.

Traditional finance often suffers from high costs, limited access, lack of transparency, and centralized control.

DeFi aims to address these issues by leveraging blockchain technology to create a more inclusive and equitable financial system.

As the DeFi space continues to evolve, it’s important to recognize that we’re still in the early stages of this financial revolution. The potential for innovation and disruption is immense, and by understanding the origins and principles of DeFi, you’ll be better equipped to navigate this exciting new landscape.

In the following sections, we’ll cover the key milestones that have shaped the evolution of DeFi, from the early days of the Omni Protocol and Tether to the game-changing emergence of Ethereum. We’ll also examine the defining characteristics of DeFi, compare DeFi to traditional finance, and discuss the potential risks and challenges that lie ahead.

Get ready to embark on an educational journey through the fascinating world of Decentralized Finance.

By the end of this course, you will have a solid understanding of what DeFi is, how it works, and why it matters.